When buying a car, you can’t just look at the price of the naked car. The final price of the car may be far from the price of the naked car. For some luxury cars, the cost of the car may be 30,000 or 40,000 higher than the price of the naked car. This also confuses friends. . Where is the money? As a financial editor, I will help you settle the accounts today.

Let's take the Audi A4L as an example. The editor got a real car purchase case in Guangzhou, which was contributed by netizens. We can use it for reference. This netizen bought an Audi A4L 2019 40 TFSI fashion national VI model with a manufacturer's guide price of 335,800. The netizen negotiated a naked car price of 266,800 at the 4S shop. After purchasing the full model, the final cost of the car was 299,100. Except for the naked car price, where is the other money spent?

Naked car price:There is not much to say about this, everyone knows it, the only thing that needs to be explained is that when bargaining with the sales in the 4S shop, don’t be confused by the total price of various packages, regardless of the various additional boutique or decoration plans proposed by the sales. Just talk about the price of naked cars, and talk about the lowest price of naked cars.

Purchase tax:The tax items required by the Internal Revenue Service are mandatory fees, and a tax payment certificate will be issued to you after paying the tax. The purchase tax is usually calculated as the face price or the lowest taxable price of the tax bureau*10%/1.17. This formula is basically applicable to all domestic domestic cars. The tax calculation method for imported cars is slightly different. The taxable price of the imported car purchase tax = the customs duty-paid price + the customs duty + the consumption tax, and the purchase tax = the taxable price * 10%. 266,800 buying Audi A4L 2019 40 TFSI fashion country VI, the purchase tax is about 22,803.42 yuan.

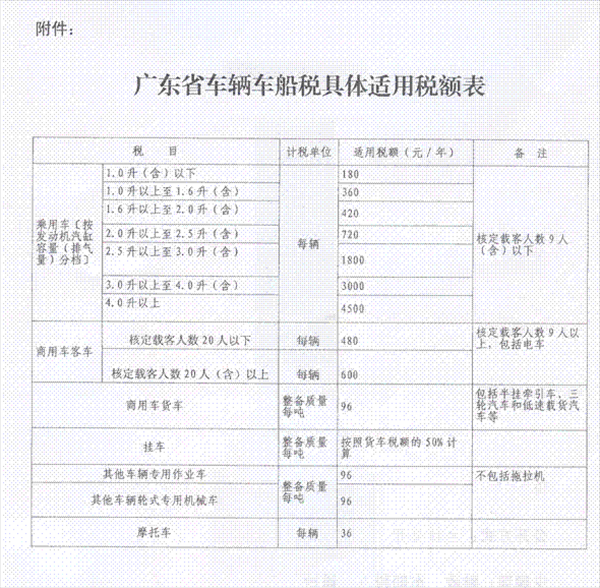

vehicle usage tax:The vehicle and vessel use tax is collected by the local tax bureau, and is generally paid by the insurance company. The collection standard is divided into seven grades according to the vehicle displacement, and the collection standard is different in different regions. The vehicle and vessel tax is different from the purchase tax. The purchase tax is only paid once when buying a car, and the vehicle and vessel tax must be paid every year. The consequences of non-payment of vehicle and vessel tax include failure to pass the annual review, invalidation of insurance, accumulated late fees, etc., late fee for vehicle and vessel tax = annual tax payable × (5/10000) × number of overdue days. The Audi A4L 2019 40 TFSI fashion national VI vehicle and ship use tax is 420 yuan. Please refer to the following table for the specific charging standards of Guangdong vehicle and ship use tax:

License fee:It is collected by the vehicle management agency, and the fees for licensing are about 120-290 yuan. The fees vary in different regions. Most of the time, car owners will choose to let 4S shops do the licensing on their behalf. The Guangzhou netizen spent 500 yuan on the licensing fee.

Boutique fee:The so-called boutique fee is collected by 4S shops, and the specific fee has a lot to do with the type, quantity, and brand of the boutique. Although it’s more cost-effective to mention the price of a naked car, but in many cases you can’t pick up a naked car in a 4S store. You have to match it with some boutique products. Generally, the 4S store will give you a thousand discount on the price of the car, but give you foot pads and spare parts. Box pads, reversing images, steering wheel covers, etc. In this case, you can calculate it. If the value of the gift exceeds one thousand, you can accept this plan. The Guangzhou netizen paid 350 yuan for fine products, including fire extinguishers, key cases, pillows, umbrellas and charcoal bags.

First year insurance:It is better to buy a car in a 4S shop now. Many 4S shops do not require the car owner to purchase full insurance, especially when buying a car in full, the car owner can configure insurance according to their needs. This Guangzhou netizen spent 950 yuan on compulsory traffic insurance and 7322.87 yuan on commercial insurance.

In summary:Guangzhou netizens buy an Audi A4L 2019 40 TFSI Fashion Type National VI, the total cost is 266800+22803.42+420+500+350+950+7322.87=299146.3 yuan.

Outgoing fee/PDI inspection fee:PDI inspection must be carried out before the vehicle is out of the warehouse to ensure that the quality of the vehicle is OK. This service is a procedure and obligation that the car manufacturer strictly stipulates to the dealer. That is to say, this service is included in the cost of buying a car, in theory, there is no need to pay separately. You can have a good talk with the 4S shop when you are charged.

Renewal Deposit:The so-called renewal deposit is a fee charged by the 4S shop. It is agreed that the car owner must apply for insurance with the designated insurance company for renewal in the coming year, otherwise the deposit will be deducted. If you are required to charge this fee when you buy a car in full, the car owner can battle with a 4S shop. However, if it is a loan to buy a car, the car owner is relatively short of chips and often passively accept it.

The above is the case of buying a car in full, so what if you take a loan to buy a car? In addition to the down payment, purchase tax, vehicle tax, license fee, boutique fee, first year insurance, etc., it is often required to buy a car with a loan. Pay financial service fees, GPS installation fees and other fees.

Financial service fee:This is a point that cannot be avoided when buying a car with a loan, and it is also controversial. The so-called financial service fee is actually charged by 4S shops, which is essentially a service fee. According to industry regulations, financial institutions cannot charge financial service fees. However, distributors such as 4S stores act as intermediary agencies to provide intermediary services to consumers and financial institutions. The service fees are acceptable, provided that the price needs to be clearly marked.

GPS installation fee:To buy a car with a loan, the lending institution often needs to follow the GPS on the mortgaged vehicle due to risk control requirements. This cost is usually passed on to the owner of the loan to buy the car. Generally, the GPS installation fee ranges from several thousand yuan.

In summary, to buy an Audi A4L 2019 40 TFSI fashion country VI with a loan, the cost of picking up the car is about 80040 (the down payment of the car price) +22803.42+420+500+350+950+7322.87+9338(financial service fee)+ 2000 (GPS installation fee) = 123724 yuan.

It can be seen that the total cost of the down payment is not low for the Audi A4L loan. Now that the popular "10% down payment" method is used to buy a car, will the down payment pressure be less, and what are the additional fees? At present, the Ping An Car Butler provides a "10% down payment" car purchase plan to buy an Audi A4L 2019 Style 40 TFSI fashion country VI, down payment 10%, about 33,500, generally no other additional costs.

Written at the end: The above comparison is still very obvious. The full amount of money to buy a car is under greater pressure, but the car owner has greater initiative, and even some unreasonable expenses can not be borne; in comparison, the loan to buy a car is for the car owner. It is a little more passive, and the additional cost to be borne is also much higher; and the emerging "10% down payment" method has the lowest down payment threshold, which brings convenience to many people and is more suitable for the following two types of people to adopt:

1. Young people who have recently worked

A low down payment to meet the monthly payment can make buying a car easier, reducing the pressure on young people to spend a large amount of money at once, and realizing the desire to buy a car in advance;

2. Businessmen who are unwilling to occupy funds and have better investment channels

This group of people is more concerned about large cash expenditures. For them, they can obtain a higher rate of return on funds through effective investment channels, and even cover the interest cost of buying a car with a low down payment, which is cost-effective.

Email:

Email: