【Car owner's family car knowledge]After buying a car, many car owners often entrust a car dealer to provide insurance on their behalf. This saves a lot of trouble, but your wallet is short of a few large bills. If you are a busy person, you don't care about this "little money"; if you still care about the difference, then find an insurance company yourself. Various insurance companies in Shanghai have preferential policies for "door-to-door" business, with discounts ranging from 5% to 15%.

Don't think that the process is difficult. In fact, you only need to make a call to the service line of the insurance company. Follow the prompt tone on the phone to contact you step by step, and the insurance company will take the initiative to find you.

Another disadvantage of having a car dealer do the insurance is that you don't have the opportunity to choose freely, because the car dealer will be insured by a fixed insurance company. Therefore, when you insure your car, it is best to compare prices and services to make sure you are satisfied.

Don't worry about doing this, you'll run into trouble with claims later. If something happens, just find the insurance salesman who signed the agreement with you. Now the insurance companies are fighting a "service war", forgive him and he will not neglect "God".

Car Damage Insurance and Three Liability Insurance

Car damage insurance is all to buy, there is no choice. But there is one point, if you only drive your car in the future, or only a few relatives and friends drive, then you can provide their basic information to the insurance company and ask to "appoint a driver", so that you can enjoy certain discounts.

As for third-party liability insurance, there is a limit of compensation (that is, how much the insurance company will pay in the event of an accident). Generally, there are several grades such as 50,000, 100,000, 200,000, 500,000, and 1 million. Look at your actual situation, the higher the compensation limit, the more premium you need to pay. However, the author recommends that novices should insure a little more, because the difference in premiums is not very large. Taking PICC's third-party liability insurance as an example, the limit is 200,000 yuan, and the premium is 1,800 yuan; while the limit of 1 million yuan, the premium is only 2,184 yuan.

Everyone must be very concerned about the mandatory third-party liability insurance and floating rates. According to industry insiders, compulsory third-party liability insurance will be launched in the second half of this year, and all motor vehicles will be covered by this insurance. However, the compensation limit of compulsory third-party liability insurance will be relatively low, and most people will need to choose commercial third-party liability insurance as a supplement. As for the floating rate of third-party liability insurance, newbies should be careful not to leave a bad note on your "white paper" driving record, which will make You will pay more premiums every year in the future, even if you change the insurance company.

What additional insurance to buy

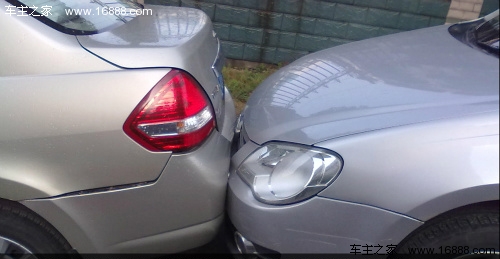

It is normal for a novice to drive a new car, and it is normal for a small accident to happen. Do you feel distressed when you face your beloved new car? Therefore, you should choose additional insurance carefully to add more protection to your car.

There are more than 10 common additional insurances for private cars, which are supplements to car damage insurance and third-party liability insurance. For example: "Single glass breakage insurance" corresponds to the "single broken glass" policy in vehicle damage insurance; "No compensation rule.

The author suggests that you can use the "exclusion method" when choosing. In addition to the uncommon types of insurance such as natural loss insurance, vehicle stop-and-go insurance, and cargo drop insurance, other types of insurance are especially the whole car theft and body scratch insurance. , Glass breakage insurance alone, on-board (personnel) liability insurance, and special insurance excluding deductibles are all recommended.

Of course, if your car is generally full of family and friends, and you have already purchased life insurance accident insurance and medical insurance, there is no need to insure car liability insurance. The car has a better anti-theft system, and there is a safe parking position and a relatively fixed driving area, so the money for theft and rescue can also be saved.

Email:

Email: